Jumbo Mortgages

Jumbo Mortgage Features

– Up to 95% financing with a loan amounts up to $850,000 (that’s only 5% for a down payment)

– Up to $3,000,000 loan amount at 85% LTV

– Aggressive fixed rate pricing often below conventional rates

– Up to 90% LTV with no MI

– If your mortgage amount exceeds the conforming loan limits then it is considered a non-conforming jumbo loan

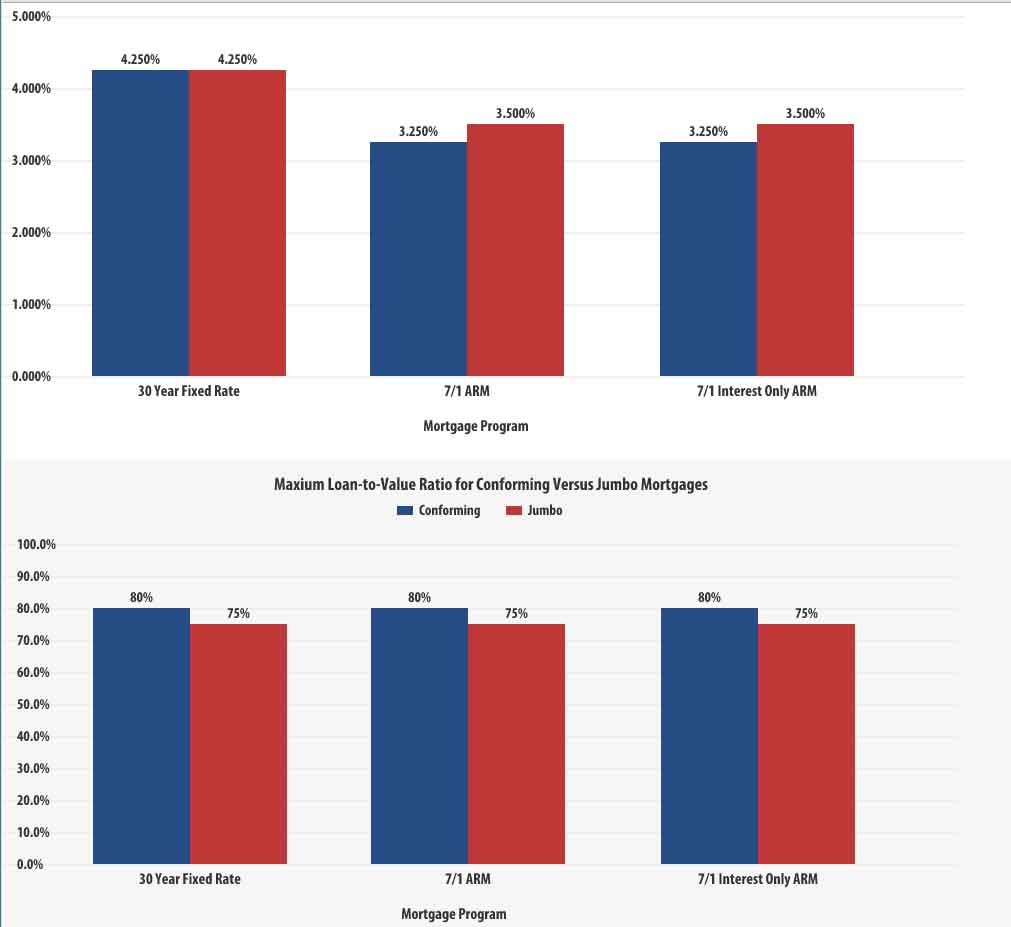

– Regardless of mortgage type — fixed rate, adjustable rate mortgage or interest only — a borrower should expect the non-conforming jumbo mortgage interest rate to be at least .250% to .375% higher than the conforming loan

— This has typically been the case; however, recently the interest rates for conforming and jumbo loans have been approximately the same for certain mortgage programs (as illustrated by the charts below)

– Lenders also typically impose stricter limits on the maximum Loan-to-Value (LTV) ratio with higher mortgage amounts

— For example, a lender may be willing to lend you $2 million dollars but may have an maximum LTV of 60%, so you are required to contribute at least 40% of the purchase price of the property through your down payment

– You will also likely see more variation in pricing and terms for non-conforming jumbo mortgages as lenders have more flexibility in setting pricing and mortgage guidelines than with conforming mortgages

– The important message is that non-conforming jumbo lenders are in competition with one another and you, the borrower, can benefit from this competition

– The charts below outline the interest rates and maximum LTV ratios for conforming and jumbo mortgages

– The charts below are examples.